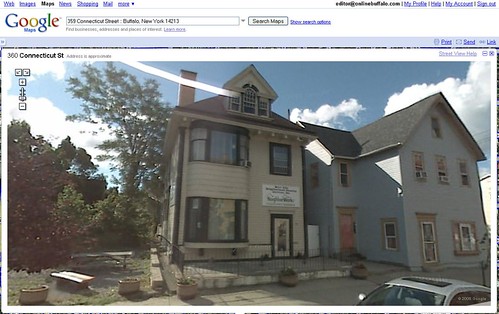

The Acquisition/Rehab Program provides eligible clients the opportunity to purchase a rehabbed home owned by West Side NHS, Inc., a certified Housing Development Organization (CHDO), at an affordable price in the West Side of Buffalo.

What is the process?

1. Find out if you are eligible

* To apply for the program

* To get a mortgage

2. Apply to the Acquisition/Rehab Program

* Must bring proof of income

* Must make a $500 deposit

* Must sign a Sales Contract

* Must take the Homebuyer Education Class

3. Work with lending institution of your choice

* Get pre-approved for a mortgage

* Fill out a mortgage application

4. Bring a copy of the mortgage commitment to WSNHS.

* Rehab begins

* WSNHS applies for eligible subsidies

5. Closing Date

6. Move In!

To Qualify:

* The Applicant must purchase a West Side Neighborhood Housing Services home in the Niagara District of the West Side of Buffalo.

* The Applicant must be a first time home buyer and be purchasing the home as his or her principal place of residence. They must remain in the home for 10-15 years. If the applicant moves out of the home, subsidies must be paid in full.

* The applicant must qualify for a mortgage loan with a financial institution.

* The purchaser is required to have a $500.00 deposit for their down payment.

**No Owner Held Mortgages!**

**Applicants Must Take a Home Buyers Education Course**

To Apply:

* Name, social security number, & date of birth for all household members.

* Payroll stubs for at least 2-months including name & address of employer.

* Proof of additional income(SS, SSI, Pension, alimony, child support , etc.)

* Proof of all income for persons living in household 18 years of age and older.

* Current monthly statement for all bank accounts.

* 2-years federal tax returns (all schedules) or have form 1722 from IRS (1-800-829-1040)

* Any Legal Document(Divorce, separation papers, etc.)

After Qualifying:

* A $500.00 Deposit.

* Sign a sales contract.

* Copy of Good Faith Estimate of closing cost.

* Copy of mortgage application or pre-approval including amount of the mortgage

Reply With Quote

Reply With Quote