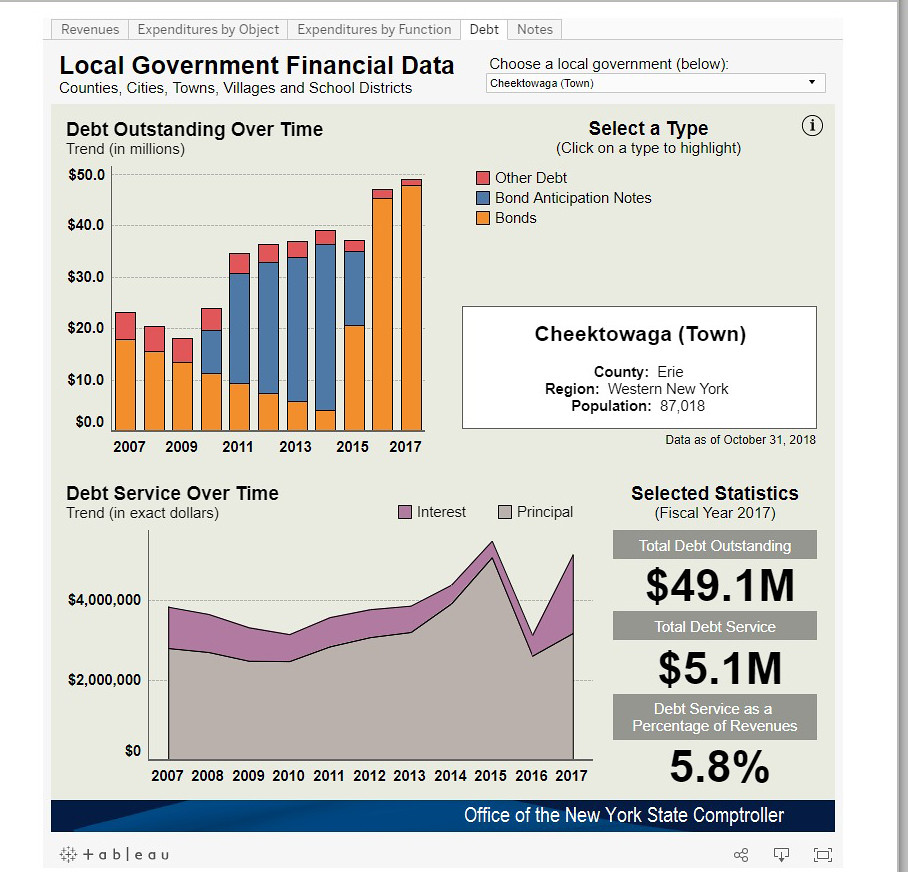

https://www.osc.state.ny.us/localgov..._debttypes.htm

Bond Anticipation Notes (BANs) - These are frequently issued as temporary financing for large construction projects and can be issued once a serial bond resolution has been adopted by the governing board. These one-year notes may be renewed for up to five years.

Bonds - Serial bonds offer a longer payback period with a stable schedule of repayment over the term of the issue. Most bonds are general obligation bonds, which are secured by the full taxing power of the local government.

Reply With Quote

Reply With Quote